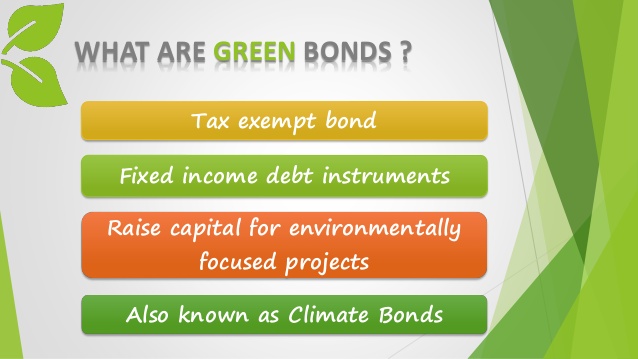

Green bonds are a type of bond that is issued to finance environmentally friendly projects such as renewable energy, energy efficiency, and clean transportation. In India, renewable power generators can sell green bonds to raise capital for their projects.

Here is a simple explanation of how green bonds work in India:

- A renewable power generator determines the amount of capital they need to finance their project and decides to issue green bonds.

- The green bonds are then sold to investors, who purchase the bonds in exchange for a fixed rate of return over a specified period of time.

- The renewable power generator uses the proceeds from the sale of the green bonds to finance their project, such as the installation of solar panels or wind turbines.

- The investors receive periodic interest payments from the renewable power generator and receive their principal back when the bonds mature.

- The renewable power generator generates clean, renewable energy and makes a positive impact on the environment, while the investors earn a return on their investment.

To issue and list green bonds or green debt securities in India, issuers must comply with the Companies Act, 2013, the SEBI (Issue and Listing of Debt Securities) Regulations, 2008, and the SEBI (Listing Obligations and Disclosure Requirements), 2015.

The Companies Act, 2013, regulates the issuance of securities by companies in India. It lays down the rules and regulations for the issue of securities, including the requirement for obtaining necessary approvals, disclosures, and compliance with the provisions of the Act.

The SEBI (Issue and Listing of Debt Securities) Regulations, 2008, govern the issue and listing of debt securities by companies in India. The regulations set out the eligibility criteria for issuers, the requirements for disclosures, and the rules for listing and trading of debt securities on stock exchanges.

The SEBI (Listing Obligations and Disclosure Requirements), 2015, requires companies to make timely and accurate disclosures to their investors and the public. It mandates the disclosure of information that is material to investors and ensures that companies maintain transparency in their operations.

In summary, to issue and list green bonds or green debt securities, issuers must comply with these regulations to ensure the transparency, disclosure, and accuracy of information related to their securities. This provides investors with the necessary information to make informed investment decisions and helps to promote the growth of the green bond market in India.

In conclusion, green bonds provide a way for renewable power generators in India to raise capital for their projects while also promoting sustainable and environmentally friendly practices. Investors can also benefit by investing in these bonds and supporting the growth of the renewable energy sector in India.